Closing Cues

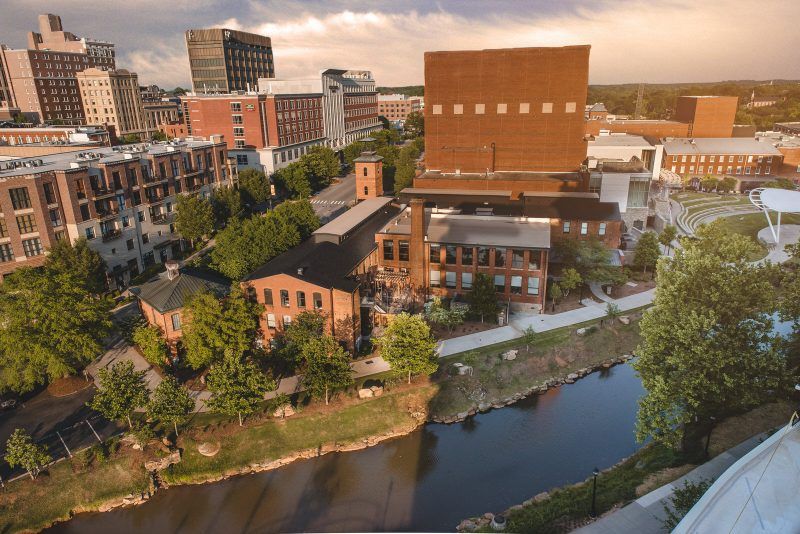

Even though this has been an unprecedented year, with it’s share of challenges and surprises, BLMC is so grateful for our wonderful community that has helped make this year a success! We are focusing on all of the amazing opportunities happening right here at home. Greenville has shown its resiliency and support for small businesses, and we want to highlight a few of these activities you can enjoy in the coming months. Downtown Greenville There are plenty of ways to enjoy downtown Greenville while still safely socially distancing! Ice on Main is open November 13 through January 31 at 206 S Main St. There is a limit to the number of skaters allowed at one time, so visit their Facebook page to reserve your spot before you go. As a bonus, Pink Mama’s Ice Cream is open each week Friday through Sunday as a fun treat after you work up an appetite with all of that skating! The TD Farmer’s Market is hosting a Holiday Edition Essential Market November 28, December 5, and December 12 from 9am to 1pm on Main Street. This is the perfect opportunity to complete your holiday shopping while supporting local businesses for unique artisan gifts. Strolling through Greenville is even more fun when it’s a winter wonderland! Downtown merchants are decorating their windows in festive attire, and visitors can vote for their favorite window scene December 9-19 by visiting the Greenville, South Carolina Official City Government Facebook page! Greer Bundle up, bring your mask, and head down to Greer’s Christmas tree lighting event on December 4 at 7:30pm. If you are looking for an all-day affair, The Greer Station Vintage Market is open the same day 2-8pm and Saturday, December 5 from 9am-4pm. Greer’s Christmas parade is Sunday, December 6th at 2:30pm and the theme is “Christmas Melodies”. Santa will make an appearance, and be sure to remain in groups with those you live with! Simpsonville The second annual Simpsonville Christmas Tree Lighting ceremony will be December 3rd at 6pm. Kaffeine Coffee Shop and Roastery is sponsoring, along with Jordan Johnson and Nikki Sword. There is also a parade sponsored by Weichert Realtors on Sunday, December 6th to enjoy.

Choosing the right mortgage can make all the difference in making your homeownership dreams come true. Many large banks and lenders showcase low rates and prices to attract customers, but later add on fees, delays, and complications that end up costing home buyers much more than they could be paying. Local lenders offer a variety of advantages for your home purchase. A local lender offers personalized service since they get to know you and your financial needs. You work directly with your lender instead of being routed through a call center. They appreciate your referrals in the local community for future business, offering a unique vested interest in your loan closing smoothly and efficiently. Also, since they take the time to study your finances individually, your loan officer can offer you specialized loans unique to your situation that big lenders won’t be able to offer. Local lenders remain up to date on regionally available specialized programs in addition to federal and nationwide lending programs typically offered by big companies. Another benefit to a local broker is their familiarity with the local market. Since they live and work in your region, they have a better sense of the lending risks and opportunities in the area. This knowledge is key to approving mortgages quickly. Finally, local lenders invest in building relationships with local realtors, providing a hassle-free experience with trusted partnerships. This unified team makes sure your closing can happen quickly with minimal stress. Local lenders offer personal service, greater flexibility, and an understanding of the local economy that big banks cannot provide. They provide the peace of mind and expertise needed to guide you through the home-buying process confidently.

One of the largest obstacles for many new home buyers is saving for a down payment. Setting aside small sums of money monthly is a great (and obvious) place to start, along with cutting back on unnecessary expenditures. Here are some additional steps to help you achieve your goal even sooner! The first step is to know how much money you need to save. If you want to avoid the cost of private mortgage insurance, you should aim to save 20 percent of the purchase price of the home. There are several federal programs that allow a smaller (or no) down payment, so contact your local lender since they can help you decide the best plan for your financial situation. Another pro tip is to automate the savings process. A payroll savings plan can allocate a certain percentage of your regular pay directly into a savings account dedicated to your down payment funds. This makes the process automatic and invisible, which removes the temptation to spend the money on other purposes. It is also helpful to bank any periodic windfalls, like tax refunds, bonuses, or monetary gifts. Regularly depositing small chunks of savings can save years off of your saving timeframe. The third tip is perhaps the most important: where to invest your down payment funds. Since this money is needed short-term, and needs to be reached within a specific timeframe, avoid risky investment vehicles like stocks or real estate investment trusts. Instead, savings accounts and certificates of deposits are safer choices. That way, the money is there when you are ready to buy a house. No matter how you save for a down payment, it is important to remember to document how you received those funds along the way. Mortgage lenders are trained to identify money laundering, so this documentation is a necessary step to avoiding issues in obtaining your loan.

Buying a home at any point is a huge undertaking, and doing so during a pandemic may bring it’s own set of fears. But purchasing a home during a health crisis may be a great move for a few key reasons. 1. Low Mortgage Rates Buying now offers the opportunity to lock in super low mortgage rates, which are near all-time lows. Current rates have been hovering just above 3% for a 30-year fixed mortgage. This results in a significant drop in your monthly payment. There is no way to know how long these historic low rates will last, so now is the time to take advantage of them. 2. Virtual Tours The ability to view homes online not only solves the public health issue, but also saves buyers a lot of time. Instead of driving to multiple appointments, video tours allow buyers to review many properties quickly and weed out undesirable homes. Once a serious contender is found, then in-person tours are conducted with qualified buyers. 3. Selling Your Current House is Easy A common complication in purchasing a new home is selling your current one. Since so many sellers removed their listings from the market (or didn’t list them at all), inventory can be low in some markets. That means you are likely to get a higher price on the sale, and that you will sell quickly. 4. More Time To Move Moving is time-consuming, and hiring movers is extremely costly. But if you have time to pack and transport even some of your belongings yourself, it’s much more affordable. Since your calendar is probably not packed with vacations and social engagements due to the global pandemic, put that free time to good use by putting money in your pocket!

Fall is just around the corner, and this busy season is even busier for homeowners. As warm nights transition to cooler temperatures, it’s time to prepare your home for anything cold weather brings. Here are some tasks to complete this autumn to make sure your home is in good shape for winter! GUTTERS Falling leaves will end up in your gutters, so clean them out (along with other debris_ to help water flow freely. Clogged gutters can cause a leaky roof, flooded interiors, and ice dams. Replaced damaged gutters with built-in leaf guards. ROOF Inspect your roof now for missing and loose shingles, since fall and winter are the worst times to have roof issues. Without a sealed roof, water damage can occur – causing deterioration to many parts of your home. A licensed, certified roofing professional can help keep this job safe. DRIVEWAY It’s easy to ignore cracks in your driveway, but these seemingly small issues can turn into big problems! Collected water freezes, expands, and makes cracks even bigger. Repair any damage with filler, then coat with a concrete crack sealer. AIR FILTERS Air filters collect dirt, dust, and allergens from the air of your home, but if clogged they cannot do their job. Most air filters last 3-6 months, so writing the date on your filter every time you replace them is a great way to keep track of your schedule. BRING THE OUTSIDE, IN You will get a lot more life out of your outdoor furniture if you store them in a protected area. Speaking of protected areas: now is also a great time to organize your garage and yard tools. When warmer weather comes around, an organized space will help motivate you to start on spring yard work.

Buying your first home can be overwhelming, but knowledge is power! Avoiding these 5 common mistakes will help you navigate this complicated process, and can even help you save money. 1. Not Knowing Your Credit Lenders review your credit report to determine your mortgage’s interest rate, and need this information to give you a pre-approval letter. Strengthen your credit score to qualify for the best rates. They also check your report again before closing to make sure nothing has changed financially, so don’t accrue any new loans or credit card accounts as this can jeopardize your final loan approval. 2. Skipping the Pre-approval Letter A lender’s approval letter shows you are approved for a mortgage loan for a certain amount. Without this letter, sellers have no proof you can afford the home in question and may not take your offer seriously. 3. Overlooking Conventional Loans First-time buyers likely don’t have deep cash reserves for a hefty down payment, so it may be difficult to qualify for a conventional loan. Explore government-insured loan programs like FHA, USDA, and VA loans which may allow you a low-interest mortgage with a small down payment. Many states also offer first-time home buyer programs which combine low interest rates with down payment and closing cost assistance. 4. Not Setting a Budget It is easy to fall in love with homes that are beyond your budget, and home shopping out of your price range can make affordable (to you) homes look disappointing – and takes away all the fun! Focus on the monthly payment you can comfortably afford, not the maximum loan amount you qualify for. Remember that maintenance services. Property taxes, various insurances, repairs, and utilities are all added expenses of homeownership (in addition to your monthly principal and interest payment). 5. Draining Your Savings Spending all or most of your savings - or raiding your 401(k) – for a down payment is incredibly risky. This leaves you exposed to unexpected expenses and hurts your retirement fund. Your mortgage payment is only part of the picture of home ownership. Set aside money for home repairs and maintenance costs, along with requesting a home inspection before closing so you have some idea of how much repairs may cost.

When homeowners lose their home and personal belongings to a fire, they look to their homeowners insurance for relief. The stress of interacting with your insurance company and it's adjustors can add to an already devastating experience. Having a local agent can help mitigate this tress. Knowing how to file a fire damage home insurance claim before the unthinkable happens can also offer peace of mind. If you evacuated due to dangerous conditions, you may not have had time to bring along your basic necessities. Ask for an advance to purchase these needed items. Be practical with our purchases and save all of your receipts. Some policies only offer “actual cash value” for personal belongings, offering less coverage. Be sure to file your claim right away. You will be asked to submit a “proof of loss” claim, which includes a list of everything you lost in the fire, including their value. Take photos and videos of your home and belongings that were damaged or destroyed as proof, and gather any receipts you can find. Some other needed information in your claim may include: date of loss, type of loss/damage, description of damaged contents, and any necessary temporary repairs. The more thoroughly you document your property losses, the faster the claims process will go. Be sure to verify what is covered by your insurance policy. The amount you receive will depend on the kind of coverage you have. While “replacement cost” coverage should cover the cost of replacing your home and property, “actual cash value” coverage will pay you the value of these items, less depreciation. For either type of coverage, you will need an estimate determined by your insurance company’s adjustor. You can also hire an independent estimator who will work for (and be paid by) you. Document all contact with the insurance company and make extra copies of all documents. It is important to note that displaced homeowners still need to continue paying their mortgage payments and their insurance premiums. Your insurance includes a policy called “loss of use”, which means your living expenses are reimbursed while home is being rebuilt. However, you are only entitled to the difference between your displaced and normal cost of living. If you are unable to reach an acceptable settlement, consider hiring a public adjustor who will negotiate with the insurance company on your behalf.

Buying a home is the largest investment most people make, so it makes financial sense for borrowers to shop around for the best terms. Your credit score is a key component of these terms: the higher your credit score is, the better performance and the lower the risk for the lender. However, many borrowers worry that multiple inquiries can negatively impact their credit score, making it even more difficult to secure low interest rates. Clients shouldn’t fear these mortgage inquiries as they are treated differently than some other types of inquiries. Your credit score is a reflection of all of the items in your credit history. There are two types of inquiries into your record report: “hard” and “soft”. Soft inquiries, like checking your own personal credit, do not impact your score at all. Hard inquiries occur when a lender checks your credit report, like when applying for a home loan or a new credit card. These hard inquiries can temporarily drop your score, but usually only by about five points. Inquiries can remain on your credit report for up to two years (with diminishing effects as time passes). While simultaneously applying for a credit card, car loan, and new cell phone plan can substantially affect your score, clustered mortgage inquiries are treated in a special way. The FICO credit-scoring model doesn’t punish consumers for shopping around for low rates. Multiple mortgage inquiries that occur within a short window (typically 14-30 days) of time are only counted as a single inquiry since they are all on the same type of product. [A word of warning, though: some credit experts have told us that you must purchase the product within this window, or the inquiries will not be bundled as one.] While your credit report may itemize each of these inquiries, your score won’t be penalized for each one. Rather, they will count as one shopping event as long as they are within this timeline of opportunity. New FICO and VantageScore scoring systems will even omit the inquiries entirely. Since different types of products cannot be bundled into one inquiry, try to avoid applying for other types of credit right before or during the mortgage process. It is important to remember that payment history is the most important factor in credit scoring. While every borrower’s credit history is unique and can be affected by various inquiries differently, clients should feel confident that mortgage inquiries will not affect their credit score in any substantial way.

Mortgage points are fees you pay a lender to reduce your loan’s interest rate. Paying for discount points is sometimes called "buying down the rate”, and it’s efficacy is dependent on your long-term financial plan. Discount points are essentially the same as prepaid interest, and are always optional. Buying discount points can lower what you pay in the long run, and can even get you closer to paying off the loan sooner, which is why it’s always good to run the numbers and find out if it’s worth the up-front cost. Typically one discount point equals 1% of your total loan amount and lowers your mortgage’s interest rate 0.25 percent (although this varies). This can save you a substantial amount if you have the loan and the lower monthly payments for a long time. Furthermore, prepaid interest may be tax-deductible on the first $750,000 borrowed, as long as certain requirements are met. When refinancing your home, closing costs are typically rolled into the loan. If you have enough home equity to cover the higher cost of mortgage points, you can finance them into the loan. This way, you can lower your monthly payment without having to pay fees up front: a win-win! While buying discount points decreases your monthly payment, it does increase the upfront cost of your loan. This is why the decision often comes down to whether you will keep the mortgage past the “break-even point” (when the monthly savings equal the upfront fee). This break-even point varies and depends on several factors, including the loan size, interest rate, and term. While discount points may make sense when buying a long-term investment property, it may be better to put that extra money toward your down payment to reduce your total loan amount. Since every situation is so varied, it is always best to talk to your qualified loan officer to find the best solution for your financial goals.